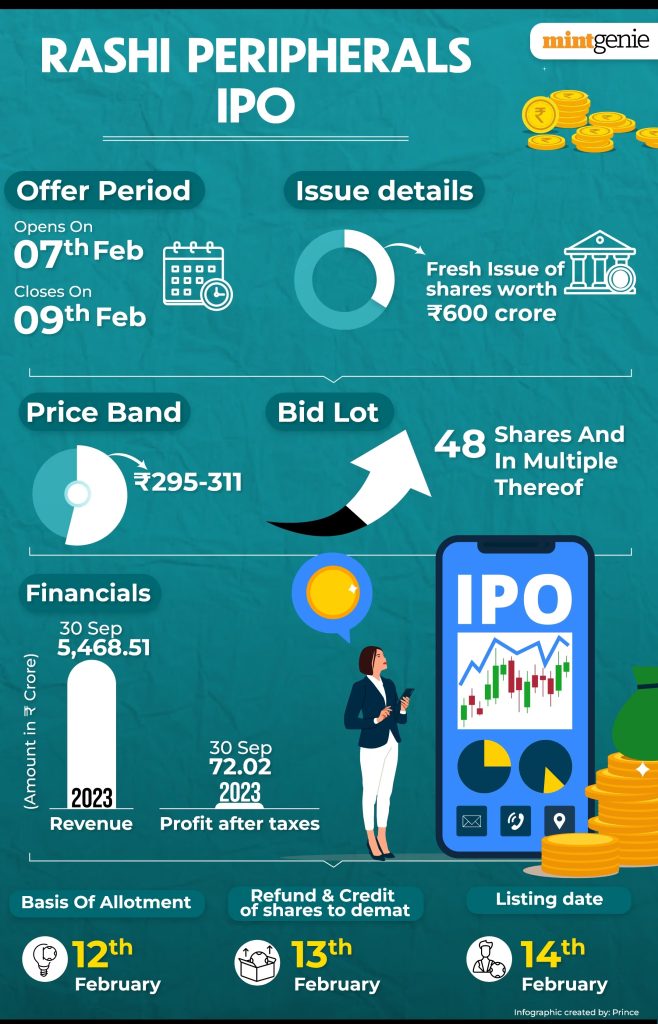

IPO: The subscription window for the Rashi Peripherals IPO, initiated on February 7, is set to conclude today. Anchor investors have contributed ₹180 crores to the IPO. Projections suggest a listing price of ₹386 per share, reflecting a 24.12% increase from the IPO’s initial price of ₹311.

The Rashi Peripherals IPO, commencing its subscription on Wednesday, February 7, is set to conclude today, Friday, February 9. Progressing smoothly into its second day, the Rashi IPO subscription status stands at 3.19 times. Notably, retail investors (3.46 times) and non-institutional investors (NII) (5.88 times) have both oversubscribed by the end of the second day.

Investors contemplating participation in the issue have the chance to subscribe today. Notably, when compared favorably to its listed peer, Redington India Limited, the company exhibits a PE ratio ranging from 10 to 10.54 times. Arun Kejriwal, the founder of Kejriwal Research and Investment Services, has endorsed subscribing to the issue.

Mohit Gulati, CIO & Managing Partner of ITI Growth Opportunities Fund, asserts that the array of brands served by Rashi Peripherals is strategically positioned to capitalize on both volume and value growth. He believes that India’s consumer trends are ascending the value chain.

The price band for the Rashi IPO has been set between ₹295 to ₹311 per equity share with a face value of ₹5. Notably, the IPO secured ₹180 crores from anchor investors on February 6. The lot size for Rashi Peripherals IPO is 48 equity shares, and investors can apply in multiples of 48 equity shares thereafter.

In the Rashi Peripherals IPO, allocation has been reserved with specific percentages for different investor categories. Notably, up to 50% of the shares in the public issue are earmarked for Qualified Institutional Buyers (QIB), a minimum of 15% for Non-Institutional Investors (NII), and a minimum of 35% of the offer is set aside for Retail Investors. This allocation strategy aims to cater to the diverse investor segments in the market.

Here are the key details for the Rashi Peripherals IPO:

- IPO Size: ₹600 crore

- Nature: Entirely a fresh issue of 1.93 crore equity shares; no Offer for Sale (OFS) component.

Utilization of Proceeds: The net proceeds from the IPO are intended to be used for:

- Prepayment or scheduled repayment of all or a portion of the company’s existing borrowings.

- Financing the company’s working capital requirements.

- General corporate purposes.

Registrar: The registrar for the Rashi Peripherals IPO is Link Intime India Private Ltd.

Book Running Lead Managers: The book running lead managers for the IPO are JM Financial Limited and ICICI Securities Limited.