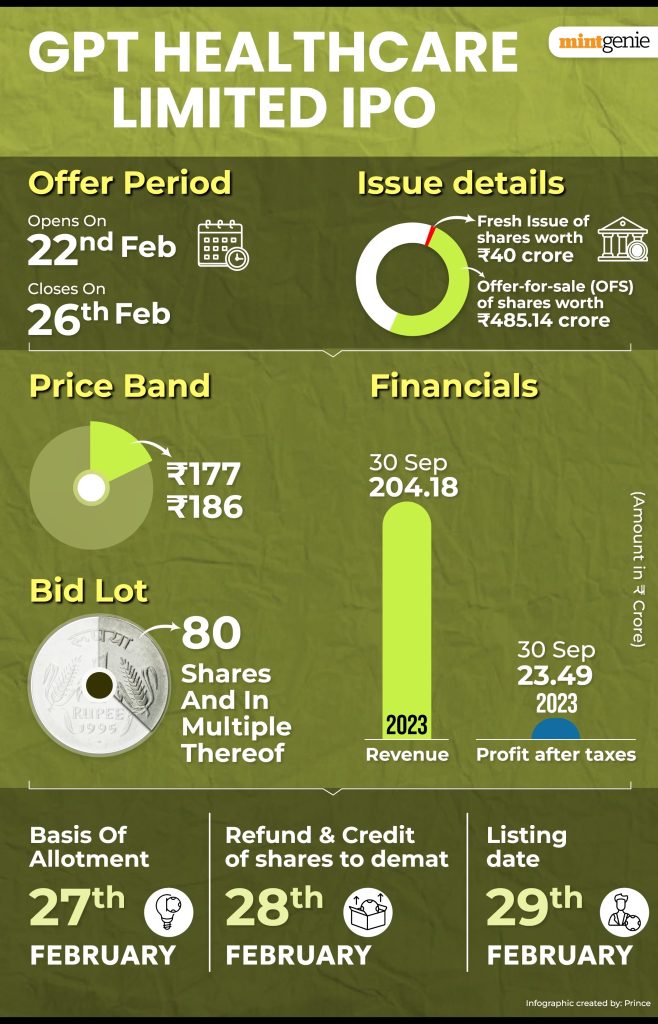

GPT Healthcare IPO: GPT Healthcare Ltd’s debut on the Indian primary market occurred today as the company launched its initial public offering (IPO). Investors have the opportunity to participate in the public issue until the 26th of February 2024, extending until the upcoming Monday. The mid-sized multi-specialty hospital has established a price range of ₹177 to ₹186 per equity share for its public issue.

The book build issue, intended for listing on both the BSE and the NSE, has already secured ₹157.54 crores from anchor investors before its upcoming initial public offering. The public subscription for this offering is set to commence on Thursday.

GPT Healthcare IPO subscription status

As of 2:27 PM on the first day of bidding, the book build issue has been subscribed 0.27 times, with the retail portion oversubscribed at 0.51 times. Meanwhile, the Non-Institutional Investors (NII) portion of the public issue has seen a subscription of 0.08 times.

Prior to the opening date of the issue, GPT Healthcare Ltd shares are trading at par in the grey market today. Market observers note that GPT Healthcare shares in the grey market are neither at a premium nor at a discount.

Important GPT Healthcare IPO details

1] GPT Healthcare IPO GMP: Stock market observers indicate that GPT Healthcare shares are currently trading in the grey market at par, with neither a premium nor a discount.

2] GPT Healthcare IPO price: The mid-sized multi-specialty hospital has set the price band for the issue at ₹177 to ₹186 per equity share.

3] GPT Healthcare IPO date: The book build issue commenced today and is scheduled to remain open until February 26, 2024.

4] GPT Healthcare IPO size: The mid-sized multi-specialty hospital aims to raise ₹525.14 crores from its public offer, with ₹40 crores expected through the issuance of fresh shares and the remaining ₹485.14 crores reserved for the offer for sale (OFS).

5] GPT Healthcare IPO lot size: Bidders can apply in lots, with one lot consisting of 80 shares.

6] GPT Healthcare IPO allotment date: The tentative date for share allocation is February 27, 2024, set for the upcoming Tuesday.

7] GPT Healthcare IPO registrar: Link Intime India Private Limited is the appointed official registrar for the book build issue.

8] GPT Healthcare IPO listing: The public issue is intended for listing on both the BSE and the NSE.

9] GPT Healthcare IPO listing date: Following the T+3 listing rule, the public issue is anticipated to debut on the secondary market on February 29, 2024, which is the upcoming Thursday.

GPT Healthcare IPO: Apply or not?

10] GPT Healthcare IPO review: Issuing a ‘subscribe’ recommendation for the book build issue, Rajan Shinde, Research Analyst at Mehta Equities, stated, “We believe GPT Healthcare Ltd provides investors with a favorable investment opportunity, focusing on a prominent healthcare provider in Eastern India. We appreciate the company’s strategic focus on the regional healthcare market in eastern India, operating in three cities with dense populations, fostering healthy growth in business and services. Their established presence and diverse healthcare delivery verticals position them as a comprehensive destination for patient needs in specific micro markets. We also believe in the company’s range of healthcare services, ensuring quality healthcare across various specialties and catering to different economic segments, enhancing their competitiveness and market penetration.”

“Analyzing the financials, there’s a moderate 7% increase in revenue from operations between FY 2022 and FY 2023, but a slight -6.37% drop in profit after tax over the same period. At the upper band of Rs.186/-, the issue proposes a Market Cap of Rs.1526/- cr. With a P/E of 32.5x based on annualized FY 2024 earnings and fully diluted post-IPO paid-up capital, the offering seems to be fully priced. Despite its robust regional presence in Eastern India and strategically positioned hospitals providing a comprehensive range of medical specialties, GPT Healthcare appears poised to capture opportunities in underserved healthcare markets and strategically expand into adjacent markets with asset-light business models, such as Ranchi. However, investors should exercise caution with IPOs that involve a 100% Offer for Sale (OFS), as this raises concerns for new investors. Therefore, considering all factors, we recommend investors to ‘SUBSCRIBE’ with risk, particularly for a long-term perspective, while conservative investors may opt to observe the space post-listing,” Shinde suggested.

VLA Ambala, a SEBI Registered RA and Founder of SMT Stock Market Today, highlighted, “GPT Healthcare, a chain of mid-sized, multi-specialty hospitals, achieved a CAGR of 36%. While witnessing a 7.11% surge in revenue, the Profit After Tax (PAT) declined by -6.37% in the fiscal year ending FY23. With plans to initiate two new projects in Jharkhand and Chattisgarh post-IPO, the company is tapping into sectoral potential. Priced at Rs. 177-186 per share, the IPO is anticipated to secure a premium listing of 25%-40%. However, it’s noteworthy that a significant portion of the proceeds will be allocated to debt repayment.”

However, Prathamesh P Masdekar, Research Analyst at StoxBox, provided an ‘avoid’ recommendation for the public issue. He stated, “Applying FY24 earnings to the company’s post-IPO equity capital, the upper price band implies a P/E of 31.7x. The company’s successful expansion into other regions of India is yet to be realized, and improvements in bed occupancy rates are necessary for a more favorable financial performance. Consequently, we recommend an “Avoid” rating for the issue. Nevertheless, we would reassess the company if there is sustained improvement in financial metrics over time.”