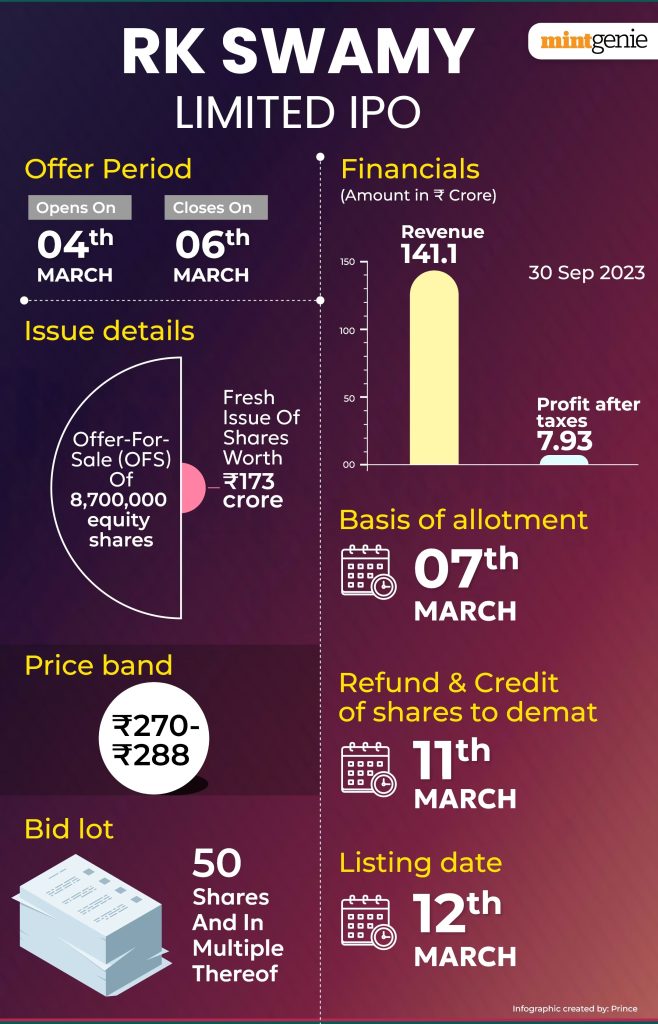

RK Swamy IPO: The initial public offering (IPO) of RK Swamy Limited is set to enter the Indian primary market today and will remain open for subscriptions until March 6, 2024. The integrated marketing communications company has fixed the RK Swamy IPO price band at ₹270 to ₹288 per equity share. The company aims to raise ₹423.56 crore through its book build issue, which includes a combination of fresh issues and offers for sale (OFS). Of the total amount, ₹173 crore is targeted from the issuance of fresh shares, while the remaining ₹250.56 crore is reserved for OFS. Ahead of the RK Swamy IPO subscription opening date, shares of the company are trading in the grey market, with a grey market premium (GMP) today reported at ₹58 according to stock market observers.

RK Swamy IPO subscription status

As of 10:54 AM on the first day of bidding, the RK Swamy Limited public issue has been subscribed 0.34 times overall. The retail portion of the issue has been subscribed 1.39 times, indicating a relatively higher interest from retail investors. The Non-Institutional Investor (NII) segment has seen a subscription of 0.36 times. The subscription numbers provide an early indication of investor interest in the IPO.

Here are some important details about the RK Swamy IPO:

- RK Swamy IPO GMP (Grey Market Premium) today: Shares of the company are trading at a premium of ₹58 in the grey market, as observed by market analysts.

- RK Swamy IPO Price Band: The price band for the book build issue is set at ₹270 to ₹288 per equity share.

- RK Swamy IPO Date: The IPO is open for subscription from today and will remain open until March 6, 2024.

- RK Swamy IPO Size: The company aims to raise ₹423.56 crore through the public issue, comprising fresh shares and an Offer for Sale (OFS). Of this, ₹173 crore is targeted from the issuance of fresh shares, and ₹250.56 crore is reserved for OFS.

- RK Swamy IPO Lot Size: Investors can apply for shares in lots, with one lot consisting of 50 shares.

- RK Swamy IPO Allotment Date: The finalization of share allocation is expected on March 7, 2024.

- RK Swamy IPO Registrar: KFin Technologies has been appointed as the official registrar for the book build issue.

- RK Swamy IPO Listing: The IPO is proposed to be listed on both BSE and NSE.

- RK Swamy IPO Listing Date: The listing of the IPO is anticipated to take place on March 11, 2024, on both BSE and NSE.

According to Dhruv Mudaraddi, Research Analyst at Stoxbox, the RK Swamy IPO receives a “subscribe” rating. Here are some key points from the analysis:

- Strategic Positioning: The company is strategically positioned to capitalize on India’s growing digital infrastructure, driven by initiatives like the ‘Digital India’ campaign and the expansion of 4G/5G networks.

- Revenue Growth: Over the past three years, RK Swamy Ltd. has demonstrated robust revenue growth, with sales increasing by nearly 70% in the last two years alone.

- Profitability Metrics: The company’s profitability metrics reflect its growth trajectory, with net profit margins reaching 10.7% in FY23, marking a ten-fold increase in net profit over the past two years.

- Efficient Resource Utilization: Impressive Return on Equity (ROE) of 69.1% and Return on Assets (ROA) of 10.0% highlight the company’s efficient utilization of resources and strong profitability.

- Valuation: From a valuation perspective, RK Swamy Ltd.’s Price-to-Earnings (P/E) ratio of 41x, based on FY23 earnings, is considered reasonable compared to the industry average P/E of 69x.

Based on these factors, the analysis suggests a positive outlook for the RK Swamy IPO, recommending a subscription to the public issue.

StoxBox and BP Equities have both provided a “subscribe” rating to the RK Swamy IPO, indicating a positive outlook for potential investors. The analysis highlights the following points:

- Valuation Perspective: RK Swamy Ltd.’s Price-to-Earnings (P/E) ratio of 41x, based on FY23 earnings, is considered reasonable compared to the industry average P/E of 69x.

- Nature of Business: The inherent nature of the digital marketing analytics business involves higher initial risk followed by a phased replication model upon successful rollout.

- Opportunity for Returns: While the IPO presents an opportunity for substantial returns, investors should be prepared for potential cyclical returns and a longer investment horizon.

Several other financial institutions, including Canara Bank Securities, Reliance Securities, Ventura Securities, and SMC Global, have also provided positive ratings, with “buy” or “subscribe” recommendations. This indicates a generally favorable sentiment among analysts and institutions regarding the RK Swamy IPO.