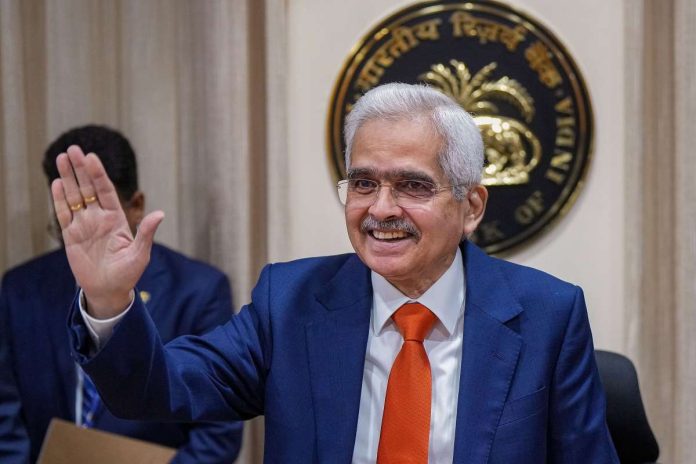

New Delhi: During the unveiling of the outcomes of the first bimonthly Monetary Policy Committee (MPC) meeting of FY25, Reserve Bank of India (RBI) Governor Shaktikanta Das identified inflation as the predominant challenge, likening it to “the elephant in the room.”

However, he expressed optimism by indicating that inflation, symbolized as the elephant, seems to be reverting to the desirable threshold of 4 percent, likened to the forest. Governor Das stated, “The elephant in the room was CPI inflation. The elephant has now gone out for a walk and appears to be returning to the forest.”

He emphasized the downward trajectory of inflation, attributed to favorable base effects, while acknowledging sustained pressure from service prices, which have kept the key indicator elevated compared to the stipulated targets.

The RBI aims to uphold inflation within a range of 2-6 percent, with a preferred target of 4 percent (+/- 2 percent).

“As central banks approach the final stretch of disinflation, financial markets are reacting to shifting expectations regarding the timing and pace of monetary policy adjustments. Equity markets are on the rise, while sovereign bond yields and the US dollar are experiencing fluctuating trends. Additionally, gold prices have surged due to increased demand for safe-haven assets,” elaborated Das, highlighting the complex interplay of factors influencing both monetary policy choices and market sentiments.

Food inflation a worry for easing inflation

While headline inflation has moderated to 5.1 percent from December’s 5.7 percent, the persistent volatility in food prices continues to pose challenges for achieving sustained disinflation. “Although headline inflation has retreated from its December peak, the fluctuating food prices are impeding the steady decline of inflation towards the target,” stated Das.

Despite a correction in January, food inflation climbed to 7.8 percent in February, primarily fueled by increases in vegetable, egg, meat, and fish prices. In contrast, fuel prices remained in deflation for the sixth consecutive month in February. Moreover, core CPI (excluding food and fuel) disinflation dropped to 3.4 percent in February, marking one of the lowest levels in the current CPI series, with both goods and services components experiencing a decline in inflation.

Additionally, the MPC observed that domestic economic activity has remained resilient, supported by robust investment demand and positive business and consumer sentiments.

Amidst hovering uncertainties, including unpredictable supply side shocks from adverse climate events and geopolitical tensions affecting agricultural production and global trade dynamics, maintaining the path of disinflation is imperative until inflation stabilizes at the 4 percent target. Therefore, the MPC opted to maintain the policy repo rate at 6.50 percent in this meeting.

It emphasized the necessity for monetary policy to remain actively disinflationary to stabilize inflation expectations and facilitate effective transmission mechanisms. “The MPC remains steadfast in its commitment to achieving the inflation target, recognizing that enduring price stability lays the groundwork for sustainable economic growth.

Furthermore, the MPC remains focused on gradually withdrawing accommodation to ensure inflation aligns with the target while supporting economic expansion,” stated Das.

Inflation forecast unchanged

The MPC, during its April meeting, maintained its inflation forecast for the fiscal year at 4.5 percent, assuming normal monsoon conditions, despite concerns over soaring summer temperatures, escalating crude oil prices, and ongoing disruptions in the supply chain due to the Red Sea crisis.

In February, India’s retail inflation remained steady at 5.09 percent, nearly unchanged from 5.10 percent, primarily due to elevated food prices. This stability led economists to anticipate that the policy rate-setting panel would keep key rates unchanged in April. However, food inflation accelerated in February to 8.7 percent from 8.3 percent in the previous month, driven by a notable increase in vegetable prices, which reached a seven-month high of 30.2 percent, compared to 27.1 percent earlier.

Repo rate, GDP forecast

On Friday, the committee opted to maintain the repo rate at 6.5 percent for the seventh consecutive time, adhering to a stance centered on the “withdrawal of accommodation.”

Additionally, the GDP growth forecast for FY25 remained unchanged at 7 percent, reflecting a positive outlook for the ongoing fiscal year.