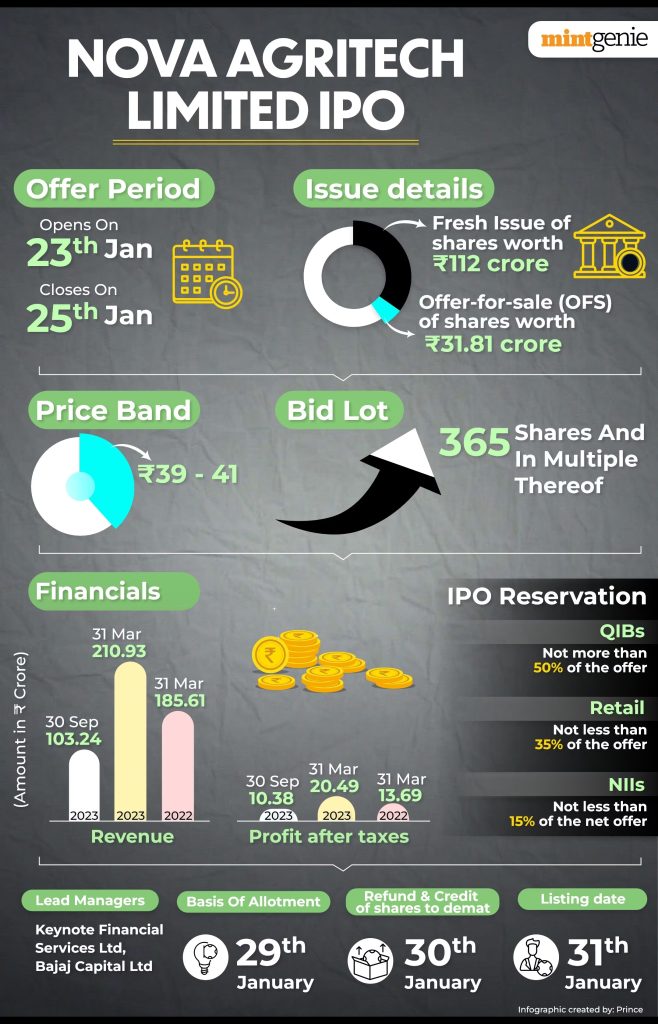

Business: The IPO bidding for Nova Agritech, headquartered in Hyderabad, commenced on January 23 and is scheduled to conclude on January 25. Nova Agritech has established the price range for its IPO at ₹39 to ₹41 per share.

The agricultural technology firm aspires to raise ₹143.81 crore through its initial offering, with approximately ₹112 crore anticipated from the issuance of fresh shares. The remaining ₹31.81 crore has been earmarked for the offer for sale (OFS).

A day prior to opening for subscription, the company secured ₹43.14 crore from anchor investors. Keynote Financial Services Ltd and Bajaj Capital Limited serve as the book running lead managers for the Nova AgriTech IPO, with Bigshare Services Pvt Ltd appointed as the registrar for the issue.

The Nova AgriTech IPO comprises a total of 35,075,205 shares, with allocations as follows: 7,015,139 shares (20.00%) for Qualified Institutional Buyers (QIB), 5,261,354 shares (15.00%) for Non-Institutional Investors (NII), 12,276,492 shares (35.00%) for Retail Individual Investors (RII), and 10,522,220 shares (30.00%) for Anchor Investors. In the event of oversubscription, a minimum of 365 shares will be allocated to 33,634 RIIs, and 5,110 shares will be granted to 343 (sNII) and 686 (bNII).

Here are key risk factors to consider to before applying to the issue –

- Negative Cash Flow Concerns:

- The company experienced negative cash flow in specific fiscal periods, and sustained negativity could adversely impact business, financial condition, and results.

- Licenses and Permits Dependency:

- The necessity to obtain and maintain various licenses and permits for business operations poses a potential risk.

- Dealer Payments and Receivables:

- Defaults in payment by dealers or delays in realizing receivables may adversely affect business and financial operations.

- Working Capital Requirements:

- Significant working capital needs and potential future capital requirements may impact operations. Access to capital depends on credit ratings.

- Government Policy Impact:

- Changes in government policies toward the agriculture sector or reductions in subsidies and incentives could adversely affect business and results.

- Trademark Protection Challenges:

- Challenges in protecting trademarks from infringement pose a risk to the company.

- Dealer Network and Operations Management:

- Ineffective management or expansion of the dealer network, operational challenges, and growth strategy execution may impact sales and profitability levels.

- Legal Proceedings and Litigation Risks:

- Involvement in legal proceedings and potential litigation by the company, subsidiaries, promoters, and directors may lead to adverse decisions, resulting in liabilities or penalties.

- Debt Agreement Conditions:

- Agreements governing the company’s indebtedness contain conditions and restrictions on operations, additional financing, and capital structure.

- Contingent Liabilities:

- The presence of contingent liabilities has the potential to materially and adversely affect business, results of operations, and financial condition.