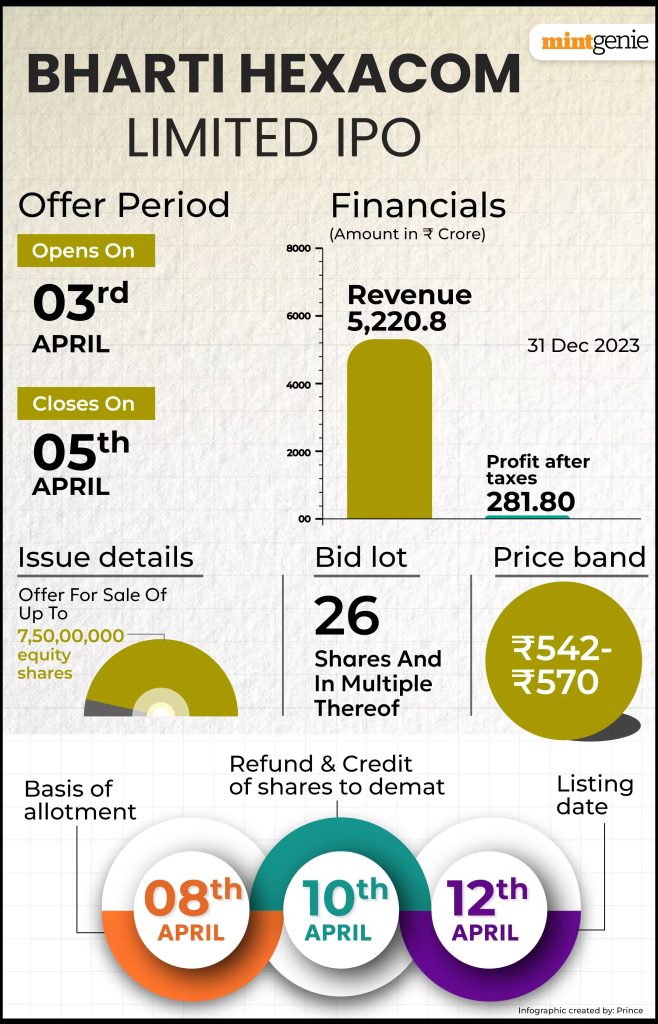

Bharti Hexacom IPO: Today marks the commencement of subscription for the Bharti Hexacom IPO, which will be open until Friday, April 5th. Priced in the range of ₹542 to ₹570 per share, with a face value of ₹5, the IPO is set to debut on the primary market. Bharti Airtel’s subsidiary raised ₹1,924 crore from anchor investors on Tuesday. Each lot of the IPO comprises 26 equity shares, with subsequent multiples being in increments of 26 shares. Notably, the FY25 market season begins with the launch of the Bharti Hexacom IPO.

75% of the offering is reserved for qualified institutional buyers (QIBs), while 15% is allocated to non-institutional investors (NIIs). Retail investors have been allocated up to 10% of the offering.

The subsidiary of Bharti Airtel, known as Bharti Hexacom, specializes in providing communication solutions to clients primarily in Rajasthan and several northeastern Indian states, including Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, and Tripura. Operating under the brand name “Airtel,” the company offers fixed-line telephone, internet, and mobile services to its customers within these regions.

According to the Red Herring Prospectus (RHP), the company’s listed peers include Bharti Airtel Ltd. (with a P/E ratio of 82.16), Vodafone Idea Ltd. (with a P/E ratio of -1.63), and Reliance Jio Infocomm Ltd.

Arun Kejriwal, founder of Kejriwal Research and Investment Services, noted a primary distinction between Bharti Airtel and its subsidiary, Bharti Hexacom. While Bharti Airtel operates globally and across India, Bharti Hexacom is predominantly focused on Rajasthan and six northeastern states, with the exception of Assam. Despite this, both companies share a similar business model. Kejriwal highlighted that Bharti Hexacom’s valuation, including its P/E multiple, represents approximately a 12–15% discount compared to Bharti Airtel.

Additionally, he mentioned that Bharti Airtel’s current high valuation indicates strong performance, distinguishing it from Bharti Hexacom.

The details of the Bharti Hexacom IPO are outlined in the Red Herring Prospectus, indicating that it comprises solely of an offer-for-sale (OFS) without a fresh issue component. The offering entails the sale of 7.5 crore equity shares, representing 15% of the OFS, by the sole selling shareholder, Telecommunications Consultants India.

Initially, Telecommunications Consultants had intended to offer up to 10 crore equity shares, as per the draft red herring prospectus (DRHP). The book running lead managers for the IPO include SBI Capital Markets Limited, Axis Capital Limited, Bob Capital Markets Limited, ICICI Securities Limited, and IIFL Securities Ltd, with Kfin Technologies Limited serving as the registrar of the issue.

Choice Equity Broking Pvt Ltd views Bharti Hexacom favorably, attributing its success to synergies with Bharti Airtel and its affiliates. Leveraging the duopoly structure, Bharti Hexacom has improved its operating and financial performance through strategic rate increases. Despite challenges such as increased barriers to entry and capital expenditure requirements, the brokerage foresees continued growth in the firm’s performance. They recommend a “SUBSCRIBE” rating for the issue.

Way2Wealth Brokers Pvt Ltd notes that TCIL, a government entity, seeks a partial exit to determine price and listing benefits. The IPO reflects the firm’s self-sufficiency in funding projected expansion. Based on 9MFY24 earnings, the issue appears fully priced, and the brokerage suggests investors “SUBSCRIBE” for medium to long-term gains.

The Bharti Hexacom IPO Grey Market Premium (GMP) is currently at +52, indicating a premium of ₹52 in the grey market. The projected listing price of ₹622 per share is 9.12% higher than the IPO price of ₹570, considering the upper end of the IPO pricing range and the current grey market premium. Analysts at investorgain.com anticipate a robust listing, with the GMP showing an upward trend over the past 12 sessions, ranging from ₹30 to ₹65. Grey market premium reflects investors’ willingness to pay more than the issue price.