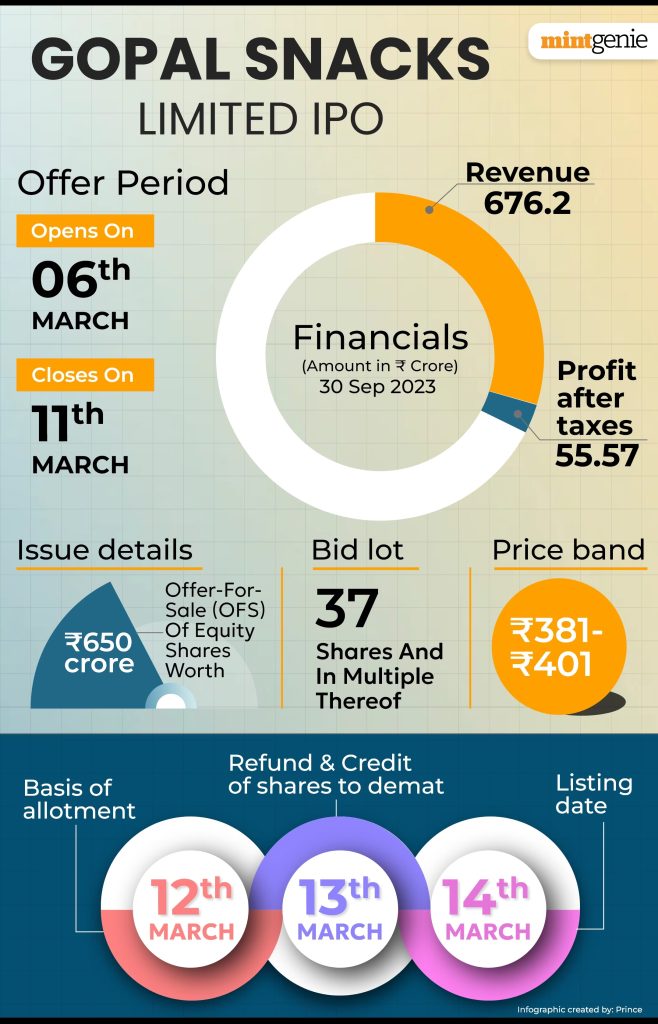

Gopal Snacks IPO: The subscription period for the Gopal Snacks IPO commenced on Wednesday, March 6, and is scheduled to conclude on Monday, March 11. The Rajkot-based company successfully secured ₹193.94 crores from anchor investors. The company officially informed the stock exchanges that it distributed 48,36,657 equity shares at ₹401 each to anchor investors on Tuesday, March 5.

The Gopal Snacks IPO has set a price band ranging from ₹381 to ₹401 per equity share with a face value of Re 1. The lot size for the IPO is 37 equity shares, and investors can apply in multiples of 37 equity shares thereafter.

The Gopal Snacks IPO has allocated shares in the public issue as follows: not more than 50% for qualified institutional buyers (QIB), not less than 15% for non-institutional investors (NII), and not less than 35% for retail investors. Additionally, there is a reserved portion for employees, with equity shares up to ₹3.5 crore. Eligible employees participating in the employee reservation portion will receive a discount of ₹38 per equity share.

Gopal Snacks Limited, headed by promoters Gopal Agriproducts, Dakshaben Bipinbhai Hadvani, and Bipinbhai Vithalbhai Hadvani, operates under the “Gopal” brand, offering a diverse range of savoury products such as papad, spices, gram flour (besan), noodles, rusk, soan papdi, namkeen, gathiya, wafers, extruded snacks, and snack pellets.

In comparison to its listed peers Bikaji Foods International Ltd (P/E of 104.67) and Prataap Snacks Ltd (P/E of 137.87), the company’s profit after tax (PAT) surged by 170.52%, and its revenue grew by 3.1% between March 31, 2022, and March 31, 2023.

Gopal Snacks IPO details

The Gopal Snacks IPO involves an offer-for-sale (OFS) of equity shares totaling ₹650 crore, including shares worth ₹520 crore by Gopal Agriproducts Private Ltd, ₹80 crore by promoter Bipinbhai Vithalbhai Hadvani, and ₹50 crore by selling stakeholder Harsh Sureshkumar Shah.

Intensive Fiscal Services Private Limited, Axis Capital Limited, and JM Financial Limited serve as the book running lead managers for the Gopal Namkeen IPO, and Link Intime India Private Ltd is the registrar.

Gopal Snacks IPO GMP today

The Gopal Snacks IPO Grey Market Premium (GMP) is +65, suggesting that the Gopal Snacks share price is trading at a premium of ₹65 in the grey market, as reported by investorgain.com. Grey market premium is an unofficial market where IPO shares are traded before the official listing on the stock exchange. It provides an indication of investor sentiment and demand for the IPO.

Considering the upper end of the IPO price band and the current premium in the grey market, the estimated listing price for Gopal Snacks shares is indicated at ₹466 apiece. This represents a 16.21% increase over the IPO price of ₹401.

The grey market premium (GMP) for today’s IPO is expected to be strong based on the activities in the last 7 sessions. The lowest GMP recorded is ₹0, while the highest GMP is ₹122, according to analysts at investorgain.com. The grey market premium serves as an indication of investors’ willingness to pay more than the issue price for the shares.

Gopal Snacks IPO Review:

Dilip Davda: “The company is one of the largest and prominent FMCG companies, mainly in namkeen and other ready-to-eat packaged foods. It has posted growth in its top and bottom lines despite declining capacity utilization, indicating its scaling margins with economical consumer packs. Based on FY24 annualized earnings, the issue appears fully priced. Investors may park funds for medium to long-term rewards,” said Dilip Davda, the contributing editor at Chittorgarh.

Swastika Investmart Ltd: The brokerage claims that Gopal Snacks is the largest manufacturer of “gathiya” snacks. Along with other fast-moving consumer items, the firm makes a range of packaged snacks that are ready to eat, including wafers, snack pellets, and ethnic namkeen. Gujarat serves as the company’s stronghold.

“However, some key risks require careful consideration, such as the business being subject to seasonality, and the market being quite competitive. While it has posted growth in its top and bottom lines.

The IPO valuation of 44.45x P/E appears fairly priced on a current basis. While the company’s future growth potential and the positive industry outlook are encouraging, thus we recommend a Subscribe rating for this IPO,” the brokerage said.