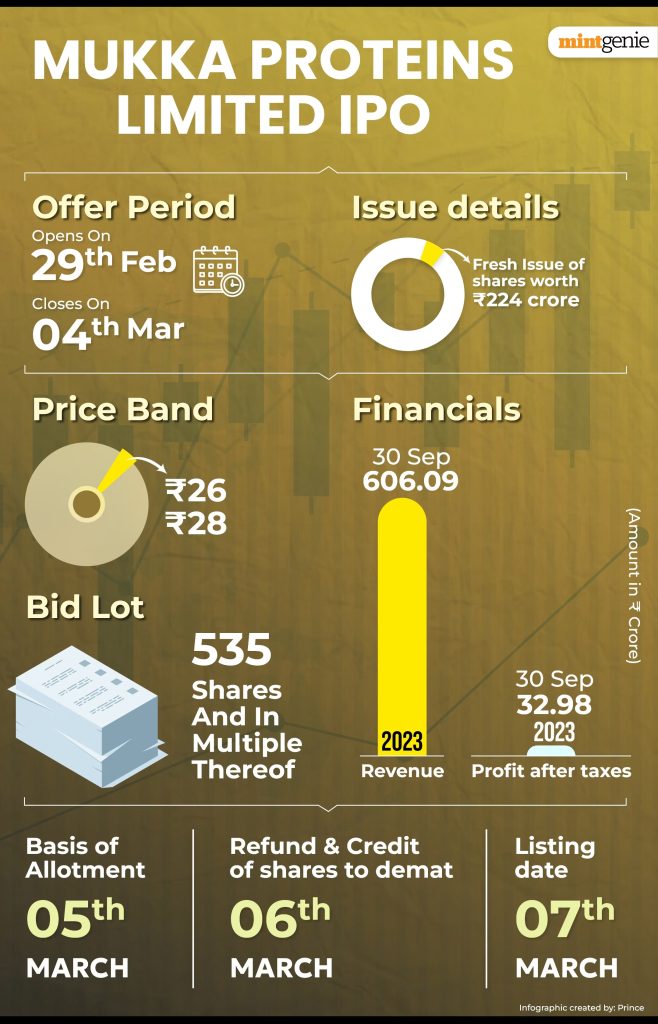

Mukka Proteins IPO: The Mukka Proteins Limited IPO is scheduled to be listed on the stock exchange on March 7, 2024. Analysts anticipate that the listing may witness a premium of over 100 percent. The expected listing price is estimated to be in the range of ₹60 to ₹66 per share. Currently, the grey market premium (GMP) for Mukka Proteins IPO is reported to be ₹36. The IPO had a price band of ₹26 to ₹28 per equity share.

Mukka Proteins IPO listing date

The Mukka Proteins Limited IPO is set to be listed on the stock exchange on Thursday, March 7, 2024. The equity shares of Mukka Proteins Limited will be listed and admitted to dealings on the Exchange in the ‘T’ Group of Securities. Additionally, as per SEBI circular No. CIR/MRD/DP/02/2012 dated January 20, 2012, the scrip will be in the Trade-for-Trade segment for the initial 10 trading days.

Mukka Proteins IPO listing price prediction

Dhruv Mudaraddi, Research Analyst at Stoxbox, anticipates a positive listing for Mukka Proteins IPO. With the IPO receiving an overwhelming subscription of over 137 times, he expects the stock to list at a premium of around 125% to the issue price of Rs. 28 per share.

Arun Kejriwal, Founder of Kejriwal Research and Investment Services, suggests that the Mukka Proteins IPO listing price may fall in the range of ₹60 to ₹66 per share. He emphasizes that the attractive valuations and the company’s strong customer base justify a robust opening. However, he cautions that the stock will be in the trade-to-trade category for the next 10 days, limiting trading possibilities and potentially leading to one-sided movement during this period. The initial trading performance, especially during the 10-day period, is considered crucial.

Mukka Proteins IPO GMP today

The grey market premium (GMP) for Mukka Proteins IPO is reported to be ₹36, representing approximately 129% of the IPO price band of ₹26 to ₹28 per equity share. This suggests that the grey market anticipates the Mukka Proteins IPO listing price to be around ₹64 (₹28 + ₹36). The grey market’s expectation indicates the potential for over a 100% return for those allotted Mukka Proteins IPO shares. However, it’s important to note that grey market premiums are informal indicators and not guaranteed predictions of actual market performance.