Delhi: In the Monetary Policy Committee (MPC) meeting held on Thursday, the Reserve Bank of India decided to maintain its key policy rate at 6.5 percent, signaling a continuation of the current interest rate stance.

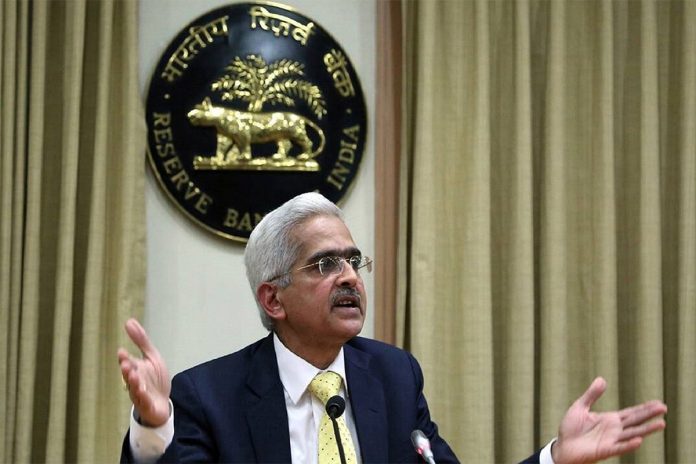

On February 8, during its Monetary Policy Committee (MPC) meeting, the Reserve Bank of India chose to maintain its key policy rate at 6.5 percent. This marks the sixth consecutive instance where the central bank has opted for a status quo. The governor, in the briefing, noted that persistent uncertainty in food prices is impacting headline inflation, while domestic activities maintain robust momentum.

Governor Das emphasized the imperative for the monetary policy to persist in actively promoting disinflation. The decision to maintain the existing rates received support from five out of the six members during the voting process.

Live coverage of RBI’s Monetary Policy announcements, the governor highlighted that global growth is anticipated to stay steady in 2024, albeit with variations across regions. While global trade momentum has been weak, it is showing signs of recovery and is expected to experience faster growth in 2024. Additionally, inflation has significantly softened and is projected to further moderate in the course of 2024.

During the previous Monetary Policy Committee (MPC) meeting held on December 8, the central bank opted to maintain the repo rate unchanged for the fifth consecutive time. Governor Shaktikanta Das announced an upward revision in the growth projection for the current financial year, increasing it to 7 percent from the earlier estimate of 6.5 percent.

The Monetary Policy Committee is tasked with the responsibility of determining the policy repo rate to attain the inflation target, while also considering the objective of fostering economic growth.

Although retail inflation in the current financial year has decreased from its peak of 7.44 percent in July 2023, it remains elevated, registering at 5.69 percent in December 2023. However, this figure is within the Reserve Bank’s comfort zone, which ranges from 4 to 6 percent.

In the previous statement, the RBI governor conveyed that he anticipates the Indian economy to achieve a growth rate of 7 percent in the upcoming financial year, while also expressing optimism about a further easing of inflation.

Governor Das acknowledged and credited the Central government for the structural reforms undertaken in recent years. According to him, these reforms have played a significant role in enhancing the medium and long-term growth prospects of the Indian economy.

“Chances of soft landing have improved and markets have reacted positively. However, geopolitical risks and climate risks remain matters of concern,” the governor had remarked.

During her interim budget address to parliament, finance minister Nirmala Sitharaman had said that India would reduce its budget gap sharply in fiscal year 2024-25 and focus on infrastructure and long-term reforms to drive growth.