Business: As per BSE data, the subscription status of the Vibhor Steel Tubes IPO stands at an impressive 27.63 times. Anticipated to debut on the market, the expected listing price for the IPO is ₹271 per share, marking a substantial increase of 79.47% from the initial IPO price of ₹151. This notable surge indicates strong market optimism and investor confidence in the company’s potential.

The Vibhor Steel Tubes IPO subscription, commencing on Tuesday, February 13, and concluding on Thursday, February 15, has garnered an enthusiastic response, particularly from retail and non-institutional investors (NIIs). Within just one hour of opening, the IPO was fully subscribed, reflecting a subscription status of 27.63 times, according to BSE data. This rapid and robust investor interest underscores the strong demand for Vibhor Steel Tubes shares in the market.

On the first day of the Vibhor Steel Tubes IPO, there is a remarkable subscription status across different investor segments. The retail investors’ portion has been subscribed an impressive 32.51 times, showcasing strong interest from individual investors. The Non-Institutional Investors (NII) portion is even more robust, being oversubscribed at 48.33 times, indicating high demand from this category. Meanwhile, the Qualified Institutional Buyers (QIB) portion is subscribed 3.56 times, and the employee portion has seen significant interest, being subscribed 27.45 times. This diverse and substantial subscription across segments reflects positive market sentiment and investor confidence in the Vibhor Steel Tubes IPO.

In the Vibhor Steel Tubes Limited IPO, the allocation has been structured to reserve up to 50% of the shares for Qualified Institutional Buyers (QIB), not less than 35% for Non-Institutional Investors (NII), and a similar 35% for retail investors. Additionally, there is a reserved portion for employees, with equity shares totaling up to ₹44.55 lakhs set aside for them.

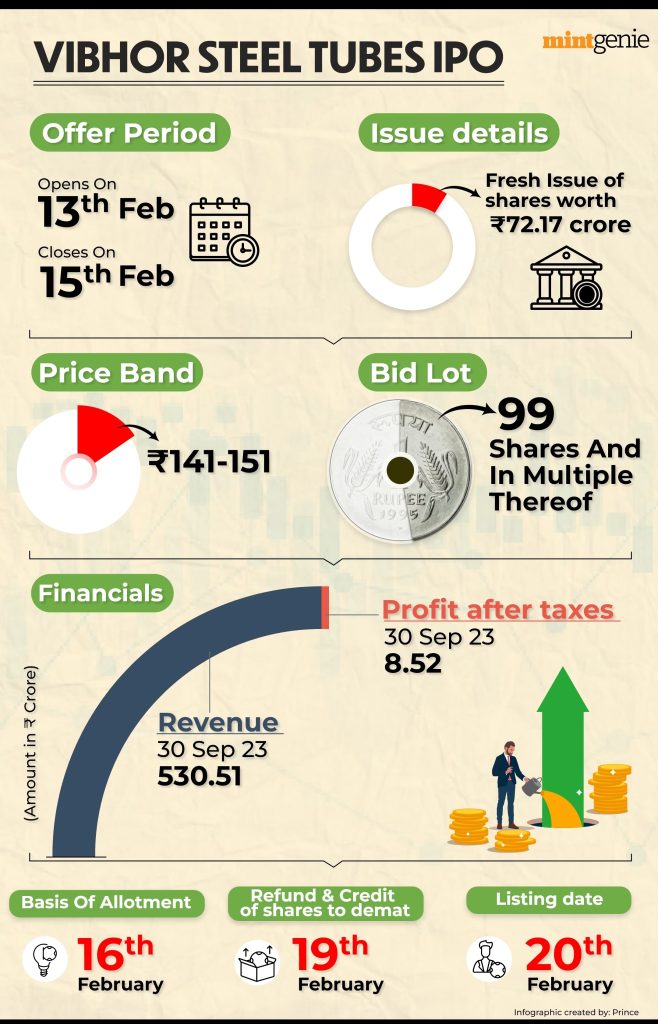

The IPO price band for Vibhor Steel Tubes Limited has been established within the range of ₹141 to ₹151 per share. The lot size for the Vibhor Steel Tubes IPO is set at 99 shares. Interested investors have the opportunity to bid for a minimum of 99 shares and can increase their bids in multiples thereof. This structure allows for flexibility in investment based on individual preferences and financial capacity.

The Vibhor Steel Tubes IPO has garnered significant investor interest, with bids for 9,92,42,550 shares against the 35,92,445 shares on offer, as reported by the BSE. Here’s a breakdown of the subscription status in various segments:

- Retail Investors: Bids received for 5,78,78,865 shares against the 17,80,386 shares available.

- Non-Institutional Investors (NII): Bids received for 3,68,74,629 shares against the 7,63,023 shares on offer for this segment.

- Qualified Institutional Buyers (QIB): Bids received for 36,21,717 shares against 10,17,441 shares available.

- Employees: Bids received for 8,67,339 shares against 31,595 shares available.

Vibhor Steel Tubes Limited IPO is valued at ₹72.17 crores and consists entirely of a fresh issue. The net proceeds will be utilized for general corporate purposes and working capital needs.

The promoters currently hold 1,32,46,500 equity shares, representing 93.40% of the pre-issue issued, subscribed, and paid-up equity share capital.

Khambatta Securities Ltd is the sole book running lead manager (BRLM), and KFin Technologies is the registrar to the issue.

As of now, the Grey Market Premium (GMP) for Vibhor Steel Tubes IPO is reported to be +120, indicating a premium of ₹120 in the grey market. The expected listing price, considering the upper end of the IPO price band and the current grey market premium, is ₹271 per share, reflecting a significant increase of 79.47% from the IPO price of ₹151. The GMP serves as an indicator of investors’ willingness to pay more than the issue price in the grey market.