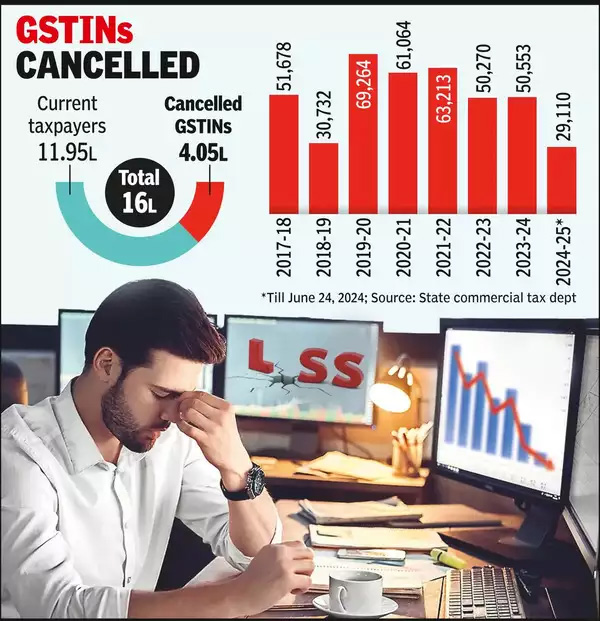

Ahmedabad: The introduction of the goods and services tax (GST) regime aimed to streamline taxes and enhance business ease. However, since its implementation, approximately 405,000 businesses in Gujarat have shut down. Data from the state commercial tax department reveals that 405,000 GST identification numbers (GSTINs) have been cancelled, indicating business closures or consolidations.

In the past two years alone, closures account for 47% of the total closures observed in the first five years of the GST regime. By the end of FY 2022, about 275,000 taxpayers had cancelled their GSTINs. The 405,000 cancellations represent 30% of Gujarat’s current 1.195 million taxpayers.

SGST officials and industry representatives attribute these cancellations to business closures, consolidations, mergers, and acquisitions. “Businesses often register for GST in anticipation of expansion. When plans don’t materialize, penalties for not filing returns prompt many to surrender their GSTINs,” an SGST department source explained. Recent consolidations through mergers and acquisitions also contributed to the increase in surrendered GSTINs, while struggling sectors led to business shutdowns.

Geopolitical events have further impacted businesses, particularly in engineering, plastics, and retail, leading to closures. Pathik Patwari, former president of the Gujarat Chamber of Commerce and Industry (GCCI), noted that the state GST department’s crackdown on bogus billing forced many shell companies to close.

Additionally, Union MSME ministry data shows that 32,298 micro, small, and medium enterprises (MSMEs) cancelled their Udyam registrations between July 1, 2020, and December 2023. This includes 2,818 units in Gujarat, the third highest among Indian states.