New Delhi: The recent survey on household consumption expenditure by the statistics office indicates that rural consumption has remained strong, closing the gap with urban areas. According to Niti Aayog CEO B V R Subrahmanyam, this could lead to a significant reduction in the poverty level in the country, possibly reaching 5% or less. He emphasized that the data suggests rural deprivation has nearly disappeared. These findings could impact RBI’s decisions on interest rates, as the share of food and cereals is lower in the retail inflation index, and the data helps dispel doubts about the state of the rural economy.

The poverty level is determined based on consumption expenditure data, and there has been a significant debate about the number of people living in poverty. The recently released data pertains to the period after 2011-12, as the consumption expenditure data for 2017-18 was not previously available. The current findings, indicating robust rural consumption and a potential poverty rate of 5% or less, could have implications for understanding the economic conditions in the country and guiding policy decisions.

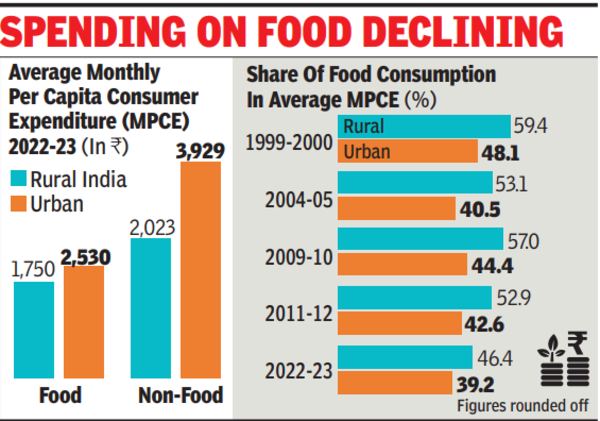

Shifts in Consumption Patterns: Rural India‘s Food Expenditure Declines to 46.4% in 2022-23 from 53% in 2011-12

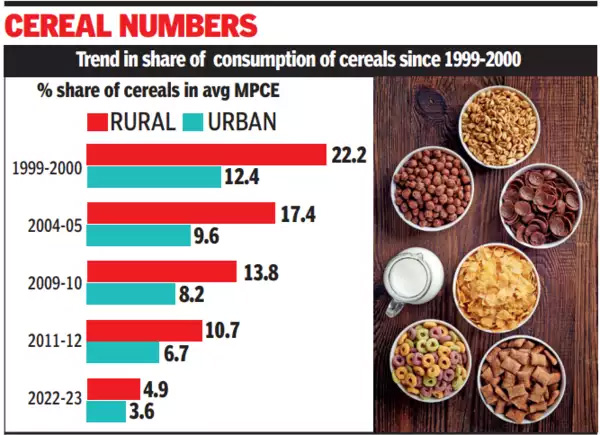

The latest data on household consumption expenditure reveals notable shifts in both rural and urban consumption patterns, indicating changes in spending habits. The share of food and cereals in consumption has decreased, while spending on non-food items such as appliances, electronics, beverages, processed food, medical care, and transportation has increased. The survey highlights a substantial rise in rural monthly per capita consumption spending, up 164% from Rs 1,430 in 2011-12 to Rs 3,773 in 2022-23. Similarly, urban centers saw a 146% increase, from Rs 2,630 to Rs 6,459 during the same period. The data suggests evolving consumption patterns with a shift towards non-food items in both rural and urban areas.

Niti Aayog CEO B V R Subrahmanyam highlighted that the latest data on household consumption expenditure, showcasing a shift in consumption patterns with a decline in the share of food and cereals, would lead to a reevaluation of the consumer price index (CPI). He suggested that the recast CPI might reflect lower inflation, as food’s contribution to CPI inflation would be reduced. This adjustment could have implications for the monetary policy decisions of the Reserve Bank of India (RBI). The data also indicates a potential significant reduction in poverty levels in India based on the estimates of the bottom 5-10% of the population’s monthly consumption expenditure.